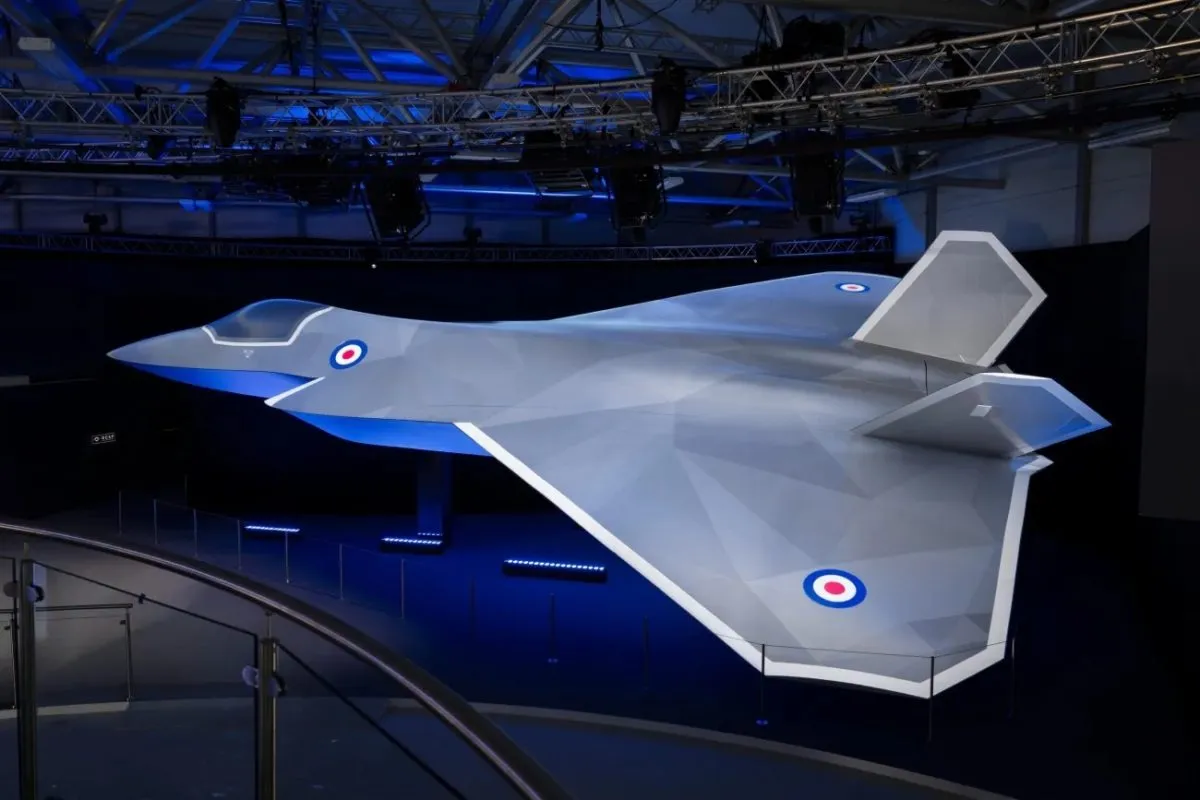

The Japanese government is considering exporting to Australia a next-generation fighter jet it is jointly developing with the U.K. and Italy, Nikkei has learned, aiming to deepen security relations through the use of common equipment.

The new aircraft will succeed the F-2, used by Japan’s Air Self-Defense Force, and the Eurofighter Typhoon, used by the U.K. and Italy. Besides Australia, India and Canada are showing interest in the jet.