To understand how China will seek to extend its critical-minerals dominance, look at how it has moved into Indonesia’s nickel industry. Over the past decade, Chinese companies, backed by state-owned banks, have been able to adapt to local policy developments, including Indonesian bans on the export of nickel ore. They have embedded themselves in industrial parks, vertically integrating the entire electric-vehicle battery supply chain from refining to recycling.

The strategy has worked with nickel in Indonesia. Expect to see it with other critical minerals in other countries.

China’s nickel investments have cemented an interdependent relationship in which it has the greatest bargaining power. This is shown in our report, published in December by the Taipei-based Research Institute for Democracy, Society, and Emerging Technology, Unveiling the Hidden Agenda Behind China’s Green Ambitions. China needs Indonesia for access to raw materials and cheap production and to bypass US trade barriers. But Chinese companies now enjoy a quasi-monopoly over the nickel industry while Indonesia remains reliant on Chinese technology, capital and markets.

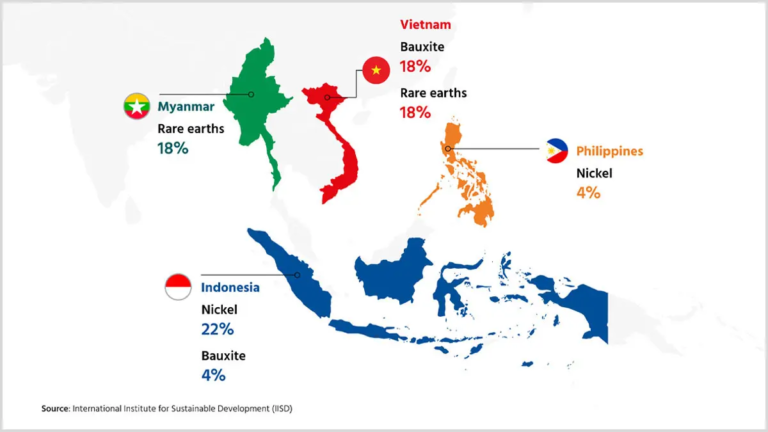

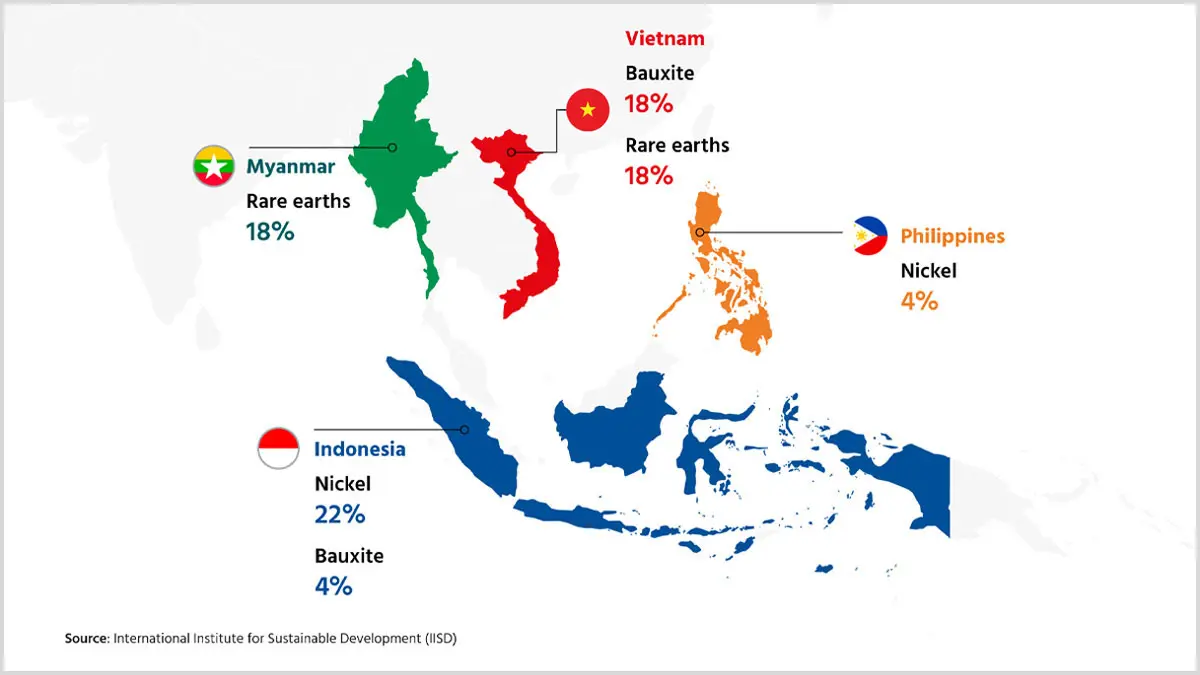

Indonesia has the world’s largest nickel reserves and accounted for 54 percent of global production of nickel ore in 2023. It is also the world’s top refiner, with 45 percent of global production. But Chinese companies control most of the value in the global industry chain—especially battery-grade nickel chemicals—owning around 60 percent of global refined nickel production. That control is an example of China’s tight grip on critical minerals, which poses global strategic risks in areas dependent on them, such as the clean energy transition.

We saw in October what China could do with such control. It expanded its export restriction list to cover five additional rare earth elements used in the production of electric vehicles, wind turbines and advanced weapons. The move threatened foreign firms with tightened licensing requirements.

The Made in China 2025 plan, launched in 2015, kickstarted China’s industrial shift towards the new energy sector and advanced technologies including solar panels, electric vehicles and batteries. These evolving industrial goals made critical minerals a national security concern for Beijing. To secure resource access, China has built upstream and mid-stream capacity overseas, including in Indonesia, which boasts the world’s largest nickel reserves.

Chinese investment into Indonesia’s nickel sector followed the model of paving the way with financing from banks that serve government policy and following up with commercial banks. Between 2000 and 2013, policy banks financed early-stage enabling infrastructure and long-term agreements to buy the product. After the launch of the Belt and Road Initiative in 2013, joint ventures with Indonesian partners became the default entry route for Chinese firms investing in nickel-related industries. Over recent years, state-owned commercial banks have gradually replaced policy banks, extending syndicated loans to distribute risk and enabling smaller-scale projects to be created in industrial parks.

The Morowali Industrial Park, the first and largest nickel processing hub in Indonesia, is a flagship project under the Belt and Road Initiative. Tsingshan Group, a Chinese private conglomerate, first entered the project through a 2009 joint venture with Indonesia’s Bintang Delapan Group then scaled up rapidly after Indonesia’s 2014 nickel ore export ban. In scaling up, it got support through the Belt and Road Initiative. Over the following decade, the industrial park has evolved production from nickel pig iron for stainless steel to battery-grade nickel chemicals. It has also begun recycling battery electrode materials, extending China’s presence in the nickel and EV battery industries.

The shift towards commercial bank-led financing over this period has also encouraged Chinese enterprises from sectors outside of mining—such as battery manufacturing and recycling—to invest in Indonesia’s industrial parks. Chinese firms have replicated the Morowali blueprint at the Weda Bay Industrial Park and Pomalaa Industrial Park, accelerating battery material production and integrating electric-vehicle ecosystems.

These industrial parks reveal a pattern of mutual reliance but uneven leverage. Through its export bans and downstreaming regulations, Jakarta gained short-term leverage and succeeded in forcing Chinese firms to localise processing to some degree. The policies have resulted in significant macroeconomic benefits for Indonesia: job creation; a key position in global battery supply chains; and economic growth. Nickel export revenues soared from US$6 billion in 2013 to nearly US$30 billion in 2022.

However, China continues to control finance, technology, and market access, leading to a long-term structural imbalance. Chinese companies control about 75 percent of Indonesia’s nickel refining capacity, raising concerns about potential green extractivism—mass extraction of resources due to an increase in demand for minerals to service the global energy transition—or challenges in the export market due to its over-reliance on China. Given the United States’ new and stricter restrictions on certain foreign and foreign-influenced entities applying for its advanced manufacturing production tax credit, the stakes are relatively high for Indonesian nickel producers to supply US battery makers due to the dominant role of Chinese foreign direct investment in Indonesia’s critical-minerals sector.

After its success in Indonesia, China is likely to continue to use this model in its foreign critical-minerals investments. Its 2023 outbound investment report argues that overseas economic and trade cooperation zones have become a key platform for firms to step out internationally in clusters, leveraging infrastructure and industrial developments to support international market expansion.

Indeed, we already see successful adaptation of the strategy to gain access to critical minerals beyond nickel and beyond Indonesia. It’s appearing in investments for mining and processing copper in Peru and cobalt in the Democratic Republic of the Congo. As more countries consider emulating Indonesia in banning the export of raw minerals and thereby promoting local economic growth, Chinese companies will be able to adapt and move up the value chain in target countries. They’ve learned how to do it in Indonesia.