The China Development Bank alone has loaned $2.2 billion to Uzbekistan, but there is virtually no publicly available information on the lending terms.

China has spent $105 billion in Central Asia over the past 22 years on development finance, of which Uzbekistan has received $18 billion. Half of this figure consists of loans from the China Development Bank (CDB) – a key financial instrument of China’s foreign economic policy.

What were these funds used for, under what conditions did Uzbekistan receive them, and what can be expected from the partnership with CDB moving forward? This article attempts to answer these questions, relying on data from AidData, expert analysis, and research by journalists from Uzbekistan, Tajikistan, and Kyrgyzstan.

Specific Interest in Central Asia

To some extent, China’s interest in Central Asia is nothing out of the ordinary. AidData records Chinese financial commitments totaling over $1.3 trillion since 2000, making China the largest source of development financing in the world. Experts on Chinese development finance Marina Rudyak and Andreas Fuchs have identified three main motives for China’s foreign aid: political, economic, and humanitarian.

In Central Asia, China has more specific aims. Jana Leksyutina, a professor at the Russian Academy of Sciences and Saint Petersburg State University, noted that China’s growing economic presence in Central Asia is driven by two main goals. First, Beijing seeks to create a belt of stability near its restive Xinjiang Uyghur Autonomous Region, and to guard against the spread of extremism and terrorist threats from Afghanistan or the Middle East.

Additionally, since the late 1990s, China has intensified the diversification of its resource import sources, including through energy cooperation with Central Asia. For instance, Turkmenistan and Kazakhstan have become major suppliers of gas and uranium, respectively.

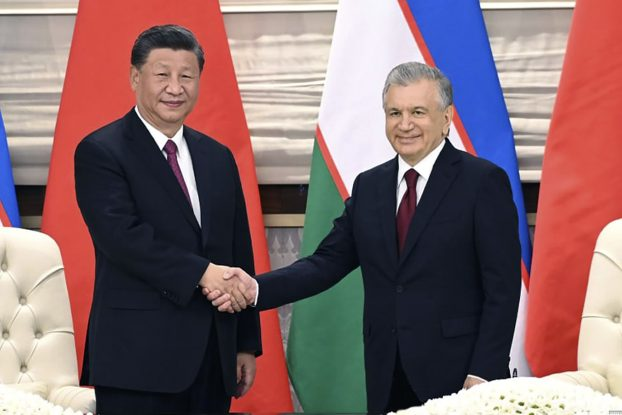

The Uzbekistan-China Partnership

After the Andijan massacre in 2005, amid international criticism, Uzbekistan found a reliable ally in China. This period marked the beginning of significant Chinese investments in Uzbekistan’s economy. According to Leksyutina, this cooperation will continue to develop against the backdrop of Uzbekistan’s sustained economic growth and its pursuit of economic openness.

The Chinese guide on overseas investments for 2023 confirmed Beijing’s interest in Uzbekistan. For example, it mentioned that the country is attractive due to low labor costs and living expenses. Additionally, it stated, “the political situation in the country is stable, public order is maintained, and laws and regulations are observed, creating a favorable internal environment for economic development.”

Nowadays, China is a hugely important economic player in Uzbekistan. By the end of 2023, Uzbekistan owed China $3.775 billion, just under 13 percent of its total external debt. It is also known that by 2022, CDB held $2.2 billion of this debt, making it the third-largest creditor to Uzbekistan. According to the Statistics Agency, China also became Uzbekistan’s main trading partner in 2023.

Where Do China Development Bank Loans Go?

Over a twenty-year period, the leading sector for financial commitments in Uzbekistan has been industry, mining, and construction (63.3 percent), which includes the largest project in the region, the Central Asia-China gas pipeline, and the Oltin Yo’l gas-to-liquids plant.The second largest sector is transport and storage, mainly related to the purchase of Boeing and Airbus aircraft. The third is the energy sector. AidData confirms that China is creating infrastructure, building, and investing mostly in projects related to natural resources.

Although small in monetary terms, the telecoms sector is also important. CDB started investing in Uzbekistan in 2007, with its first loan of $15.5 million going to Uzbektelecom. A year earlier, the bank had allocated $70 million to Tajikistan for the development of the cellular company TK Mobile and $6.6 million to the Kyrgyz telecommunications company Kyrgyz-Telecom.

Special Treatment for Chinese Companies

According to the latest AidData survey of 1,650 public leaders from 129 countries, their expectations of cooperation with China in development often align with Beijing’s real terms – more dollars and fewer political conditions, albeit with lower transparency, opportunities, and quality. Due to the low level of transparency on both sides, there are virtually no publicly available documents on lending terms.

We sent inquiries to the National Bank of Uzbekistan and the Ministry of Investments of Uzbekistan, but received no responses. Therefore, we will rely on the experience of neighboring countries, and through joint work with journalists from Kyrgyzstan and Tajikistan, we will try to infer the terms under which China lends money to Uzbekistan.

Information published in 2015 on the website of the Association of Banks of Uzbekistan about the specifics of the CDB credit line indicates that it covers up to 85 percent of the contract value for equipment imports, but at least half of this equipment must be purchased in China. The minimum loan amount is $100,000, with no maximum specified. The grace period for the project is two years, and the total loan term can reach eight years.

AidData also records that the executing agencies for most projects are private and state-owned Chinese companies. Temur Umarov, a research fellow at the Carnegie Russia Eurasia Center in Berlin, noted that because “Chinese loans are often tied to additional conditions, such as the obligation to use Chinese companies for project implementation at the local level, there is a risk of limiting counterparties for the borrower.”

In Tajikistan, similar lending conditions apply. Most importantly, over half of the equipment purchased with concessional loans must be of Chinese origin. Expert Pairav Chorchanbaev said that one of the main lending conditions in Tajikistan is the implementation of the project by a Chinese company. When constructing infrastructure projects, the contractors install Chinese technologies and equipment, and replacement parts must be purchased from Chinese manufacturers. Chorchanbae noted that these conditions are convenient for China but not very favorable for the recipient country, as the lack of competition can affect overall quality.

Additionally, in the Government of the Republic of Tajikistan decree from May 30, 2012, No. 252, paragraph 6.5 stated that Chinese contractors working on the territory of Tajikistan under the project for the rehabilitation of the Dushanbe-Kulma road are exempt from paying taxes, including customs duties, VAT, excise, profit tax, and income tax on wages paid in foreign currency. This raises questions about the benefits of the agreement for Tajikistan.

Debt for Resources Agreements

Loans provided by the CDB and the Bank of China for the Central Asia-China gas pipeline project are planned to be repaid through gas sales. Leksyutina noted that China does not mind receiving debt in non-monetary form, such as obtaining rights to manage critical infrastructure or licenses for resource development.

For example, in 2019, the Chinese company TBEA received the right to develop the Upper Kumarg and Duoba gold deposits in Tajikistan in exchange for previously spent funds on the construction of the Dushanbe-2 thermal power plant.

This is confirmed by statements from Kyrgyz politicians. In 2021, President Sadyr Japarov and in 2022, Prime Minister Akylbek Japarov (no relation) stated that in case of non-repayment of the debt to China, control of strategic facilities would be transferred to China. It is also worth recalling the history with Tajikistan when in 2011, 1,158 square kilometers of territory was transferred to China.

Corruption Schemes

Another risk of cooperation with Chinese banks and companies is implication in corruption schemes. In 2021, the CDB was at the center of an anti-corruption campaign, resulting in the dismissal of nine senior executives. In September last year, former CDB vice president Zhou Qingyu confessed to taking a bribe of 5 million yuan ($712,000).

There have also been multiple instances of corruption involving Chinese companies in Kyrgyzstan. For example, after the reconstruction of the Bishkek Thermal Power Plant by the Chinese company TBEA Co., Ltd., criminal cases were initiated in Kyrgyzstan under charges of corruption and abuse of official powers against several officials, including former prime ministers Sapar Isakov and Jantoro Satybaldiyev. The General Prosecutor estimated the damage to the state at $111 million. Isakov was also accused of lobbying for TBEA’s interests, and later charges were brought against ex-president Almazbek Atambayev.

Besides this case, in 2018, CRBC, which is implementing the “North-South” road project, was accused of inflating construction costs to $3 million per kilometer, and in 2021, the Kyrgyz State Committee for National Security suspected the company of inflating prices by $123 million.

The China Development Bank’s huge quantity of loans to Uzbekistan over the last two decades has raised concerns and questions regarding the country’s long-term prospects. The requirement that a significant portion of Chinese-financed projects in Central Asia use Chinese equipment and services may limit local economic benefits and technological autonomy. If debts cannot be repaid, there is also a high risk of losing control of strategic assets, as evidenced by similar situations in neighboring countries. Finally, the possibility for corruption in such large-scale financial operations might undercut the intended developmental advantages.